For business fleets, tracking fuel expenses is part of managing budgets, tax reporting, and compliance. If you don't have a company fuel card, you'll need to collect paper fuel receipts, but anyone who’s tried to collect them from employees knows how difficult the process can be. Receipts get lost, fade over time, and pile up in filing cabinets, leaving accounting teams with hours of manual work each month.

The good news is, you don't need to collect gas receipts if you use a business fuel card. In this article, we’ll explain why businesses collect fuel receipts, the common problems with managing them, and how fuel cards simplify tracking fuel expenses by automatically collecting and organizing the data you need for you.

Table of Contents

- Why businesses collect gas receipts

- Problems with collecting fuel receipts

- How fuel cards eliminate the need to collect fuel receipts

Why Businesses Collect Gas Receipts

For most businesses, tracking fuel purchases is essential for accounting, compliance, and tax reporting. Accurate documentation provides proof of expenses and helps quantify fuel budgets and tax deductions. Below are the main reasons why tracking fuel purchases matters and why many businesses still rely on paper receipts to do it.

1. More Complete Fuel Data

Credit card statements only show the merchant name, date, and total amount. Fuel receipts add key details like gallons, fuel type, price per gallon, and location, giving businesses the information needed for accurate expense tracking.

2. Tax Deductions

Receipts document business fuel purchases that qualify for tax deductions. They reduce taxable income and provide proof of purchase in case of an IRS audit.

3. Fuel Expense Reimbursement

Some businesses have employees buy fuel with their own personal credit cards and reimburse them for the fuel expenses later. Employees must turn in their gas receipts with their monthly expense reports as proof of purchase.

4. Expense Tracking

Fuel receipts include data that must be entered into an accounting system to total monthly fuel expenses. This information helps companies analyze and forecast their fuel budget.

5. Fleet Recordkeeping Compliance

Fleets that are required to report to IFTA use fuel receipts to submit their fuel purchases by state. Many fleets are also required to abide by the FMCSA hours of service rules and may be asked to show their fuel receipts during a DOT inspection.

It is important for business owners to understand the specific requirements and deductions related to fuel expenses in their jurisdiction. Consulting with a tax professional or referring to the applicable tax guidelines can provide businesses with specific guidance and ensure compliance with tax laws.

Problems with Collecting Fuel Receipts

Collecting fuel receipts from employees can be a challenge. Drivers often forget to grab a receipt or lose it before turning it in. Once receipts are collected, they must be manually entered into your accounting system and filed for recordkeeping. It’s a time consuming, error prone process that adds unnecessary administrative costs.

Here Are the Common Problems with Collecting Fuel Receipts:

- Receipts are easily lost or damaged, leaving no backup record of transactions.

- Gas pumps run out of receipt paper and won't print a receipt for your driver.

- Sorting and reviewing paper receipts wastes time that could be spent elsewhere.

- Accounting teams must manually total and organize purchases, increasing the risk of errors.

- Reporting and reconciliation are delayed due to manual entry.

- Locating older receipts for audits can be tedious and frustrating.

- Receipts fade over time and can become unreadable.

- Without digital records, businesses lose visibility into spending across drivers, vehicles, and departments.

How Fuel Cards Eliminate the Need to Collect Fuel Receipts

Fuel cards collect the fuel transaction data you need for recordkeeping and store it in your online account which eliminates the need to collect fuel receipts. Here is how fuel cards accomplish this task.

Fuel Cards Collect More Transaction Data than Fuel Receipts and Credit Cards Combined

Fuel cards capture more information per transaction than fuel receipts and credit cards. A typical credit card transaction only collects basic Level 1 transaction data such as the total amount, date, and merchant name. Fuel receipts provide additional transaction details, but depend on drivers to submit them and accounting teams to record them properly.

In contrast, fuel cards collect Level 3 transaction data directly from gas stations, including the price per gallon, number of gallons purchased, fuel type, and location. Drivers are also required to enter a Driver ID and odometer reading at the pump, and each card can be tied to a specific driver, vehicle, and department. This combination of automated and user entered data gives businesses complete visibility into who fueled, what vehicle was used, where the purchase occurred, and how much was spent, insights that receipts and credit cards can’t provide on their own without manual accounting work.

Fuel Card Data Collection Compared to Fuel Receipts and Credit Cards

| Fuel Card | Fuel Receipt | Credit Card | |

| Merchant name | ✅ | ✅ | ✅ |

| Date | ✅ | ✅ | ✅ |

| Time | ✅ | ✅ | ❌ |

| Total | ✅ | ✅ | ✅ |

| Card number | ✅ | ✅ | ✅ |

| Address | ✅ | ✅ | ❌ |

| City | ✅ | ✅ | ❌ |

| State | ✅ | ✅ | ❌ |

| Zip | ✅ | ✅ | ❌ |

| Gallons | ✅ | ✅ | ❌ |

| Price per gallon | ✅ | ✅ | ❌ |

| Fuel type | ✅ | ✅ | ❌ |

| Pump number | ✅ | ✅ | ❌ |

| Odometer | ✅ | ❌ | ❌ |

| Driver name | ✅ | ❌ | ❌ |

| Vehicle description | ✅ | ❌ | ❌ |

| Vehicle number | ✅ | ❌ | ❌ |

| Tax breakdown | ✅ | ❌ | ❌ |

| Dept. or GL number | ✅ | ❌ | ❌ |

| MPG | ✅ | ❌ | ❌ |

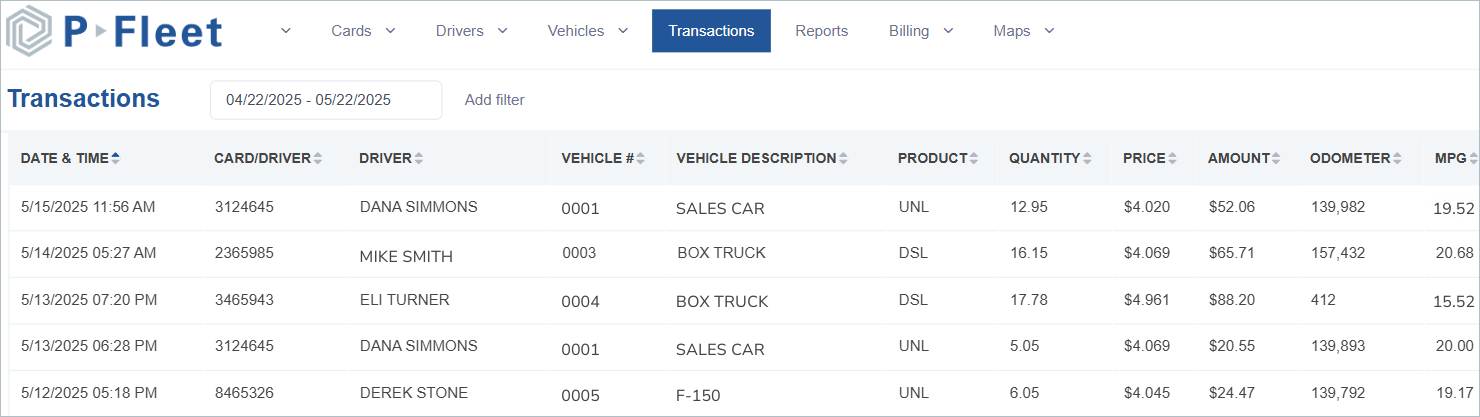

Fuel Cards Organize and Store Transaction Data in Your Fuel Card Portal

After fuel cards collect this transaction data, they organize it into useful fleet fuel reports that can be viewed in your fuel card portal and downloaded into Excel. This data is also stored so you can access it years down the line in case of an audit. Here are some examples of what you can do with fuel card reporting.

Fuel Card Reporting Makes it Easy To:

- Upload fuel transactions into your accounting system for expense reporting

- Download reports for fuel taxes

- Total gallons by state for IFTA reporting

- Allocate fuel expenses by department, GL, or job number

- View transactions by driver or vehicle

Fuel Card Invoices Can Be Used for Audits

Instead of storing hundreds or thousands of fuel receipts that fade over time, you can download and submit your fuel card invoices as proof of purchase for audits. Since all fuel transaction data is organized into a single consolidated invoice for each billing period, submitting invoices during an audit requires only a fraction of the paperwork compared to sorting through hundreds or thousands of paper receipts.

Track Your Business Fuel Expenses with P-Fleet Fuel Cards

With P-Fleet Voyager and CFN fuel cards, you can track every fuel purchase without collecting, storing, or sorting paper receipts. Each transaction is recorded with detailed Level 3 data, including gallons, fuel type, price per gallon, driver, vehicle, and location. This data is stored in your online fuel card portal, where you can view and download reports anytime.

Whether you manage a few vehicles or a large fleet, P-Fleet’s fuel card programs simplify expense tracking, improve accounting accuracy, and save your accounting team valuable time.