Fuel card fraud can be an unsettling experience. The first sign is often unexplained charges from locations far outside your drivers' normal routes. As you retrace steps, scrutinize driver activity, and comb through statements, the reality becomes clear: your card information has been compromised and used for unauthorized purchases, sometimes for days or weeks before detection. Typically, this involves criminals skimming and cloning your fuel card data to buy fuel at your company’s expense.

The next steps are familiar to many fleet managers: cancel the affected card and notify your card provider. However, some providers don’t offer fraud coverage, leaving your business responsible for losses that can quickly add up to hundreds or even thousands of dollars. Because fuel card fraud is increasingly sophisticated and often difficult to detect immediately, businesses may find themselves at risk. Still, effective strategies and proactive measures can make a difference. In this article, we’ll explain how fuel card fraud operates, outline the steps you should take if you’re affected, identify which fuel card providers offer fraud protection, and provide recommendations on how to safeguard your fleet against future threats.

Table of Contents

- How does fuel card fraud happen?

- What you need to do if you experience fuel card fraud

- Do fuel card companies cover fraudulent transactions?

- Fleet fuel cards with fraud protection

- How to protect your company from fuel card fraud

How Does Fuel Card Fraud Happen?

The most common way fuel card fraud occurs is through the process of card skimming and cloning. Here's how the process works.

Step 1: Fuel Card Information is Skimmed at the Pump

The fraudster opens the gas pump and installs a skimming device that is connected to the internal parts of the card reader or puts an identical skimmer cover over the card reader. This device collects and stores card numbers and pin numbers for all cards used at this card reader. This device usually has Bluetooth capabilities so the fraudster will return to the station with a cell phone or computer and connect with the device via Bluetooth to download the stolen card information, all while remaining in their vehicle.

These skimming devices are difficult for gas stations to prevent as they are smaller than a USB stick and are easily installed on the inside of the pump. Some gas stations will install additional locks and antitamper security stickers that can show if someone has opened the pump to install a device. The issue is that these fraudsters can still break into pumps and will replace antitamper stickers with nearly identical replacements to bypass these security measures.

Step 2: Fraudster Makes a Clone Card

After the fraudster downloads the skimmed fuel card information they use it to encode blank fuel cards. Credit card encoders and blank credit card stock are so publicly available that they can be purchased from Amazon.

Step 3: Fraudster uses Clone Card to Purchase Fuel on Your Account

Now the fraudster takes the stack of cloned cards to gas stations and starts purchasing fuel. This fuel is usually sold to truckers at a largely discounted rate. Here are the two ways fraudsters deliver stolen fuel to their customers:

- Fraudster meets customers at the fuel station: Fraudster notifies their customers and meets them at a fuel station to fill their trucks directly at a discounted cash price.

- Fraudster fills a bulk tank and delivers the fuel to customers: Some fraudsters will have box trucks or pickup trucks with large hidden tanks installed in them to fill up and then deliver to customers. Picture a pickup truck with a 1,000 gallon tank in the bed and it has a bed cover over the tank so it looks like a normal pickup truck from the outside. The bulk tank is connected to a filler nozzle positioned where the truck’s regular fuel cap is, making it appear as though the driver is simply refueling the vehicle when the driver is actually filling the bulk tank.

Fuel Fraudsters Often Work in Groups

Usually fuel card fraudsters work in small groups to scale their operations and prevent being caught. So one person may be skimming the fuel card information in California and then the cloned cards are made and used in Florida. This makes it harder for law enforcement to track and prosecute the crime as the crime takes place in many different jurisdictions.

What You Need to Do If You Experience Fuel Card Fraud

If you notice fraud on your account here are the steps you need to take:

- Immediately cancel the compromised fuel card.

- Contact your card provider to see if the transactions are covered.

- If fraud is covered, follow the process of submitting a fraud claim for investigation and reimbursement.

- Open a police report in the area where the fraudulent transactions took place.

Do Fuel Card Companies Cover Fraudulent Transactions?

Some fuel card companies do and some don't. Usually this information will be outlined in the terms and conditions during the account application process. For fuel card companies that offer fraud coverage usually there are terms and conditions involved such as minimal fuel card controls that need to be in place on the fuel cards to qualify. This is to incentivize cardholders to set adequate controls that will reduce the impact of fraud. Fuel cards without adequate controls will result in much higher fraud claim amounts.

Fleet Fuel Cards with Fraud Protection

Here is a comparison of how top fleet fuel card companies help customers protect their customers from fraud. These fraud protection features can be broken down into two categories:

- Fraud protection: Tools to help prevent fraud.

- Fraud coverage: Reimbursement offered for fraudulent transactions.

| Fuel Card | Fraud Protection | Fraud Coverage |

| Voyager | Real time fraud monitoring and alerts | Free fraud coverage |

| CFN | Real time fraud monitoring and alerts | Free fraud coverage |

| Fuelman | Real time fraud monitoring and alerts | Fraud loss coverage $10K per card or up to $25k per account per year on Pro and Enterprise plans |

| WEX |

|

N/A |

| AtoB |

|

Fraud loss coverage up to $250,000 based on eligibility and fleet size. |

| Coast |

|

Fraud loss coverage up to $25K per year |

| Pacific Pride | Real time fraud monitoring and alerts | Free fraud coverage |

How to Protect Your Company from Fuel Card Fraud

Business owners don't want to pay for fuel card fraud and fleet managers don't want to tell the owner that uncovered fuel card fraud is going to cost the company hundreds or thousands of dollars. The good news is that some fuel card companies provide the fraud protection and coverage you need to so you don't have to worry about fuel card fraud. Here's how you can protect your company from fuel card fraud.

Choose a Fuel Card that Offers Fraud Coverage

If you are using all the fraud protection tools your fleet card provides, it's very unlikely that fraud will occur on your account. However, even with the tools there is always a small chance of fraud. That small chance can turn into hundreds or thousands of dollars in fraudulent transactions that you won't want to be liable for.

Get a fuel card that offers fraud coverage so if fraud occurs on your account, you're covered. You dispute the transactions with your fuel card provider, your card provider investigates the transactions, and then you are reimbursed for the fraud. There's no financial loss for your company.

It's important to read your fuel card provider's fraud coverage details as you'll want to make sure your following the guidelines to be compliant with their fraud coverage. Many fuel card companies that offer fraud coverage will have rules such as a time period that the fraud needs to be reported in and fuel card controls that you need to have in place to mitigate the damage to qualify.

Carefully Review Fuel Card Fraud Alerts

Most fuel card companies will have a fraud monitoring system that uses algorithms to detect suspicious purchase behavior. The fuel card company will then suspend the affected fuel card and notify you to verify the transactions to reopen the card if the transaction is valid. It's important to fully review these alerts before confirming the charges and reactivating a fuel card as reopening a fuel card that is compromised may make you liable for future fraud activity on the card since you verified the transactions.

This is what you should do if you receive a fraud alert:

- Match GPS data with the transaction date, time, and place to verify driver was at the station purchasing fuel at that time.

- Ask the driver to verify the transaction.

- If valid, change the fuel card pin and reactivate the fuel card.

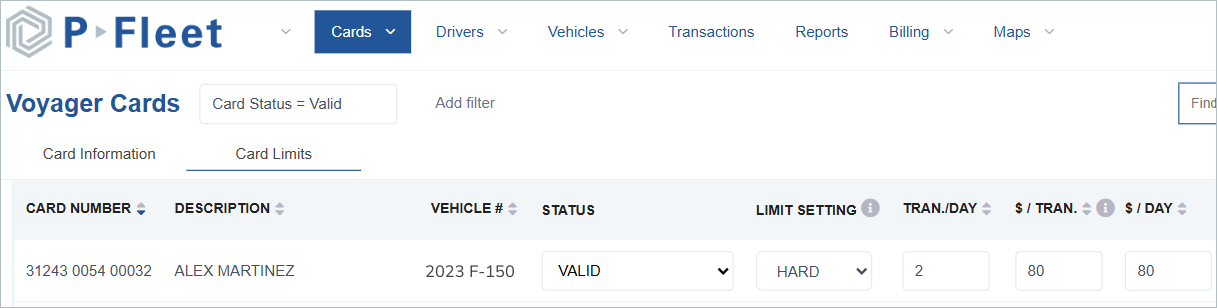

Don't Have Excessive Fuel Card Spending Limits

Sometimes we see people set fuel card spending limits such as dollars per transaction or day to a much higher amount than what drivers actually need. This leads to more damage if fraud does occur on your account.

For example, you could have your fuels cards setup for $500 per transaction with 3 transactions per day, yet your drivers never purchase more than $80 in fuel in a day. If a card gets frauded, the fraudster can get up to $1,500 dollars in fuel per day with those settings. If you had your card limits set at $80 per day to cover your drivers fueling needs and a card got frauded, your max exposure per day would be $80. Turning in a fraud claim for $80 is way less stressful than dealing with a fraud claim worth $1,500.

Here's the best way to set fuel card spending limits;

- Set dollars per transaction and day to the vehicle's fuel tank capacity: For example, for a vehicle with a 20 gallon tank and the local fuel price is $3.50 per gallon, set the dollars per transaction and day limit to $70.

- Review purchase history to identify cards with excessive card limits: Review the last 90 days of transactions for each fuel card and compare largest transaction for each fuel card with their spending limits. For cards with much higher spending limits, adjust the controls to match what the card actually needs.

- Set transactions per day to 3 or less: When fraudsters clone your card and start using it at the pump, they usually will usually try to max out the card as quickly as possible before you find out. If you have fuel cards that are setup with 10,20, or even 30 transactions per day, the fraudster can run up your bill quickly before the fraud monitoring system shuts down the card. In contrast, if your cards only allow for 2-3 transactions per day the card will shut off at 2-3 transactions and hopefully the fraud system will catch the activity and cancel the card with only 2-3 fraudulent transactions.

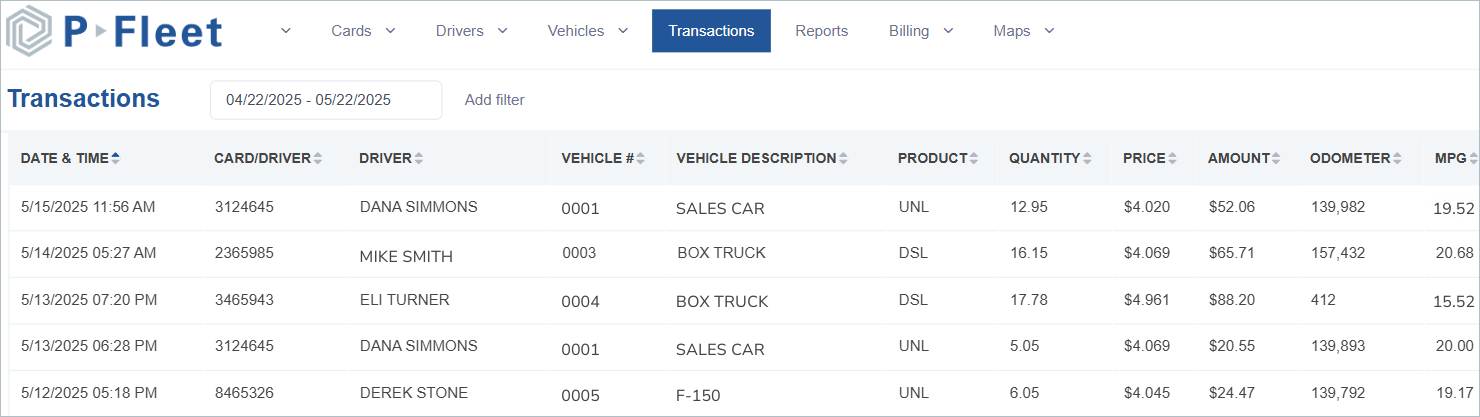

Regularly Monitor Your Fuel Card Account

Your fuel card portal should make it easy to review your daily transactions in just a few minutes. Make it a habit to check your daily transactions in at some point of your day. Maybe with your morning coffee or after you check your morning emails.

You can also set up fuel card alerts which will be sent via email to help you catch suspicious fueling activity. Here are the types of fuel card alerts you can set up.

Fuel Card Alerts

- E-receipts

- Product exceptions - purchasing wrong type of fuel

- Driver transaction errors

- Fueling outside of business hours or days

- Fueling away from designated locations

- Alerts when specific cards are used

Get Free Fraud Coverage with P-Fleet

With P-Fleet CFN and Voyager fuel cards you'll get the tools you need to protect your fuel card account against fraud and free fraud coverage for the unlikely chance that fraud occurs on your account. You can apply online for a P-Fleet fuel card to get started.

Here's how P-Fleet helps you keep your fuel card account safe:

- Robust spending controls to limit fraud exposure.

- Real time fraud monitoring and alerts that will notify you of suspicious transactions.

- Easy to use customer portal to review transactions.

- Free fraud protection is included if card skimming occurs.