Discount network access

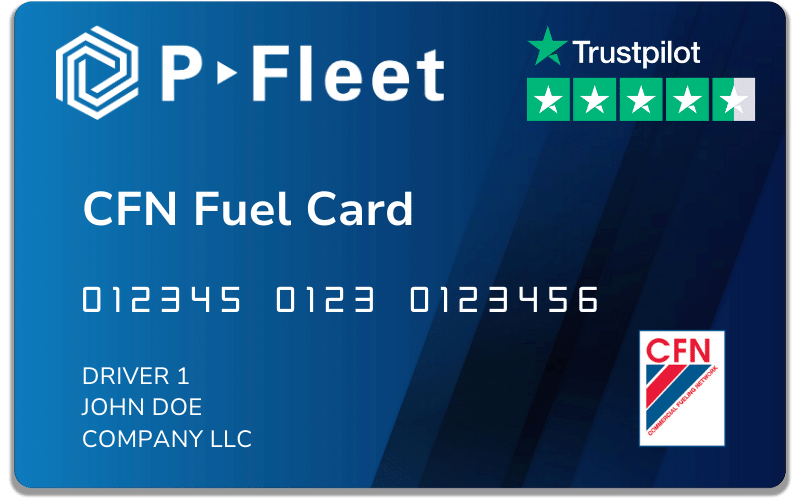

If you operate in the West, choose our CFN fleet fuel card with discounts to save money.

If you operate in the West, choose our CFN fleet fuel card with discounts to save money.

Add on select retail brands or choose our universal fuel card to access all major brands.

Standard customers don't pay any transaction fees when using our fleet cards for business.

We offer cost-plus or retail-minus pricing at CFN sites. Contact us today to request a quote.

Reducing expenses and controlling costs is a top priority for most companies. It increases profitability and enables investment in other areas of the business. When it comes to fuel expenses, it's important to have a strategic fuel program in place to protect your bottom line against fluctuating fuel prices.

Many trucking companies and business fleets rely on P-Fleet for commercial fleet fuel cards to manage their fuel expenses. We offer various fleet fuel cards so that your drivers have a convenient payment method for fuel purchases.

But our card program does even more. It enables managers to limit purchases at the card level and then track company spending as purchases occur. Receive fuel discounts at select locations to lower your costs and fraud protection for your account to ensure peace of mind.

Below are some additional advantages that customers experience when using our fleet fueling cards.

Fleet cards are frequently used to save money on fuel. Drivers can use P-Fleet's CFN card at discount fuel sites in the CFN network. CFN locations use a cost-plus pricing model, which bases fuel prices on wholesale costs and adds a lower markup than retail stations and truck stops. With access to CFN sites, your business can potentially save significantly on fuel.

The Voyager card helps trucking companies and business fleets reduce fuel expenses by simplifying access to low-cost brands. With the Voyager card program, drivers can compare fuel prices of major and independent brands from their mobile devices, allowing them to easily shop for the best prices. As with all P-Fleet cards, Voyager has zero transaction fees, giving your drivers the freedom to choose the lowest-cost brand without incurring additional costs.

As the primary payment method, a universal fuel card makes tracking employee purchases much easier. Some companies reimburse employees for fuel purchases. Others might issue cash or company credit cards but require drivers to submit receipts for every purchase. These methods are time-consuming and tedious.

By contrast, a fuel card transaction is more secure than using cash or credit cards, and it eliminates administrative time spent on processing and issuing reimbursements. If an employee loses a fuel card, it can be easily deactivated. Plus, P-Fleet offers free fraud protection for customers should unauthorized use occur.

Ensure drivers have the fuel they need when they need it while preventing misuse with P-Fleet fuel cards.

Through our convenient online portal, you can set limits on how much fuel individual drivers can purchase by gallon or dollar amount. You can also authorize specific times and days that transactions can occur for each driver. If you need to provide fuel cards per vehicle, you can customize spending limits for individual vehicles as well.

Customizable spending controls are included with your account, whether you select a CFN or Voyager card.

Whether you're an established company or a new, small business, a P-Fleet fuel card account can help you manage cash flow. We offer billing periods of 3, 7, 15 or 30 days so that you can choose the best payment cycle for your budget.

A P-Fleet account also simplifies the tracking of fuel purchases, helping you maintain oversight of every dollar spent. Access detailed reports in the customer portal and see when, where and how much fuel was purchased. Leverage this data to identify spending patterns and streamline budgeting for future expenses. You can also use spending data to pinpoint opportunities to save on fuel and free up cash for other business objectives.

With detailed reporting capabilities and expense tracking, a fuel card account can ease the workload of administrative teams. Accounting and administrative teams no longer have to tally up fuel expenses from spreadsheets or receipts throughout the year. Instead, they can download transactions or a summary report directly from the P-Fleet customer portal to streamline accounting processes.

Depending on your needs, we can also provide custom data files that your team can import into their accounting software. Contact our team to learn more about our tailored solutions.

A fleet fuel card isn't just useful for purchasing fuel. Your company can also use it to cover vehicle maintenance costs if you enable that option for your drivers. Fuel cards provide a convenient payment method for essential vehicle maintenance expenses, like oil changes, tire purchases and various repair services.

With a single payment method for fuel and maintenance costs, monitoring and accounting for these expenses is much easier, especially if you have multiple vehicles in your fleet.

We support thousands of fleet card customers nationwide and understand the pressure of running a business that's growing because that's how we got started. Our team is committed to providing the best gas cards for business and the highest level of service (without all the fees) so that customers get the support they need. Read our customer reviews to see why they rate us highly.

Read our customer reviews to see why they rate us highly.

Various types of fleets benefit from using CFN. Customers get access to a discount network of 3,000 cardlock fueling sites covering the western United States. Commercial cardlock locations are built to accommodate large trucks and equipment, and many sites include high-speed dispensers so that drivers can refuel quickly. Companies that operate beyond the West can add select retail and truck stop brands for extra coverage.

Customers can access 3,000 cardlock sites with cost-plus pricing available.

Add on 57,000 retail locations for extra coverage. Select by fleet fuel card depending on driver routes.

Industry-best fleet fuel card controls to limit driver fueling only to what they need for their vehicle.

Dyed diesel, CNG, LNG and DEF products available at select sites to accommodate fleets.

Companies nationwide benefit from using Voyager. Customers have the choice of over 320,000 gas stations and truck stops anywhere in the U.S. for unrivaled brand access and total convenience. Because fleet cards for business are accepted across major and independent brands, cardholders gain the flexibility to choose the nearest location as well as the brand with the lowest price. Optional maintenance purchases can also be enabled.

Customers can choose from 320,000 retail fuel sites in the U.S. for total convenience.

Accepted at major brands and 10,000 independents, giving cardholders flexibility.

Comprehensive fleet fuel card controls to limit employee purchases and prevent misuse.

For those drivers that need it, provide access to 60,000 maintenance locations.

With discount fuel locations and universal acceptance as available options, we can help your company determine which fleet card is the right fit for your needs. P-Fleet has been serving customers since 1986, which means we have experience working with fleets of all sizes. We believe businesses should be treated fairly, and we're driven to help our customers thrive. Count on us to support your needs.

No setup fees, transaction fees or late fees. CFN prices are online, and with Voyager, you pay the merchant pump price.

Manage fleet cards for fuel, check transactions, download invoices, and run reports. See an interactive demo today.

Simplify processing and account for every purchase with free reports for accounting and upper management.

Set gallon or dollar limits, control transactions per day and authorize fueling days and times.

Adjust limits to fit each of your drivers or vehicles for total control and flexibility.

Utilize fraud alerts and e-receipts to catch suspect fueling or monitor specific cards.

Download the CFN-Fleetwide or Voyager mobile app so that drivers can find locations when on the road.

Apply certain fuel tax exemptions at the time of fueling or track gallons that qualify for refunds. Our tracking solutions allow you to maximize savings on every dollar.

Our customer service team is committed to providing the highest level of support for customers. We're ready to help.

Fleet fuel cards are useful for reducing fuel costs and streamlining how purchases are made and monitored. However, it's important to select the right card for your operations. Depending on your industry, you might prioritize different card features and benefits over those of another company.

Let's take a look at the types of businesses that can benefit most from our fleet fueling cards.

Fuel cards are beneficial for delivery companies because they offer access to multiple gas stations. With more locations to choose from, completing deliveries becomes a lot more efficient for drivers.

In addition, fuel cards allow managers to set spending limits and track consumption to further optimize efficiency and ensure operations are cost-effective.

For trucking companies, fuel cards are essential for managing expenses. Each purchase at the pump can be significant because trucks carry so much fuel.

Fuel cards offer nationwide access to truck stops and commercial stations that offer discounts to help companies reduce costs. In addition, card programs offer detailed reporting to help simplify IFTA filings.

Many construction companies have a mix of vehicles and equipment that need fuel. Fuel cards are useful for managing the types of products that are purchased and how much.

This could include a combination of unleaded, diesel and dyed diesel. With a card program, companies can track usage and identify gallons eligible for tax refunds if used in equipment.

Government fleets often require flexibility yet strict accountability when it comes to vehicle fueling, and fuel cards can accommodate both objectives.

Fuel cards offer access to multiple fueling stations and can be set up to allow purchases 24/7, especially if being used for emergency response vehicles. Strict purchase controls and centralized reporting are also available so that cities and municipalities can ensure public funds are being spent appropriately.

Our goal is to fuel better business. P-Fleet can provide you with a fuel card for business expenses so that your company can operate more efficiently on the road and receive discounts on fuel whenever possible.

You can count on us to be your trusted fuel card provider. We have decades of industry experience, and providing excellent customer service is our priority. With millions of gallons sold, we've helped fuel businesses across the country and across industries. Contact us today to learn how to get a fleet fuel card for your business.

P-Fleet's customer service is outstanding. I can ask for anything, anytime and have it in a minute.

It's so easy to get new cards or cancel old ones. I just pick up the phone. I don't even think I've waited to talk to a person.

I do everything on P-Fleet's website. It's a major advantage when managing our fleet.

A fleet card, or fuel card, allows companies to set spending controls and receive discounts on fuel across a network of service stations. Businesses and commercial fleets often make use of a fuel card because it allows them to reduce expenses and gain detailed information about their fueling. This is especially important for fleet managers that oversee several drivers and vehicles.

A gas card can be used at gas stations, truck stops or a commercial network of fuel stations. A card is normally issued to a customer by a fleet fuel card company. The customer swipes the card at the pump to access fuel, and afterward the fuel card company invoices the customer.

To obtain a business gas card, first assess your company's fuel needs and research reputable providers like P-Fleet that offer tailored solutions. Complete an online application by providing your business details and estimated fuel usage; this typically involves a soft credit inquiry that won't affect your score. Upon approval, set up your account by defining spending controls and limits for each card. Once your account is active, issue gas cards to your drivers, allowing them to refuel at participating stations while you efficiently track expenses and manage your budget.

The fuel card that saves the most money depends on the type of business you operate, how much fuel you purchase and which features are most important to you.

There are many options available from different vendors intended for different fleets. Some fuel cards are designed for small fleets, others for large fleets. Some cards offer access to a broad network of fuel stations and even maintenance. Others might offer fewer stations but better discounts.

It's important to consider the discounts, fees and features before making a decision.

Company fuel cards offer several benefits, including discounts on fuel, credit terms, detailed reporting and purchase controls. Controls can be used to prevent unauthorized use by drivers, and some cards include free fraud protection.

A fleet fuel card is different from a credit card because it is intended for vehicle fuel or maintenance purchases. Unlike credit cards, fleet fuel cards for small businesses can limit how many gallons or dollars worth of fuel that drivers can buy at gas stations or truck stops. Drivers are also prompted to enter vehicle information at the pump to track fuel efficiency.